The New York Federal Reserve's report indicated that fintech firms have driven up unsecured lending rates in the US, especially in the past decade. These loans surged as a share of balances, and the raw amount of unsecured personal lending also hit a record high.

This increase has been driven by digital lending platforms and online-only banks that offer personal loans, which have significantly swelled the unsecured personal lending market.

Fintech companies now originate 38% of unsecured personal loans, which is a drastic rise from just 5% in 2010. This increase could be due to the convenience, speed, and user experience offered by fintech firms, making them popular among consumers.

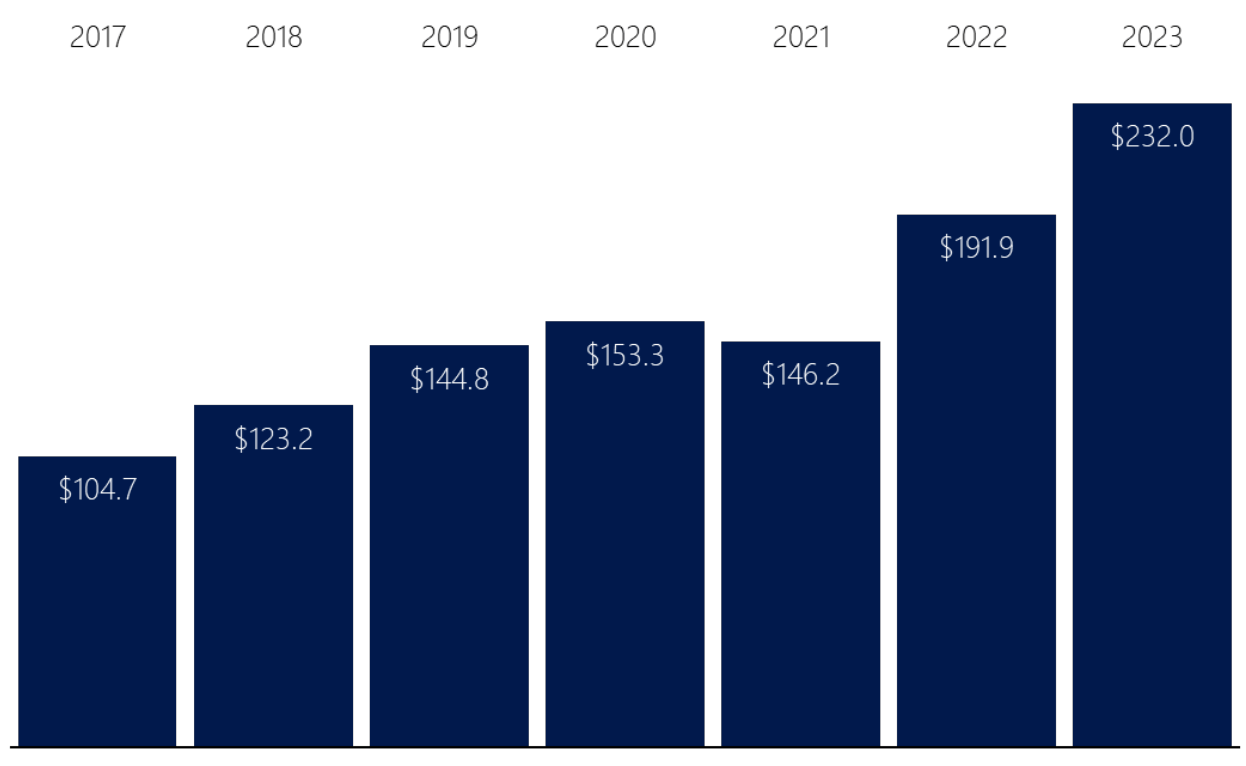

Unsecured personal loan balances reached $232 billion by 2023, up $40 billion from 2022 and $86 billion from 2021, indicating a significant market need.

Our Opinion:

The growth and success of nonbank fintech firms providing unsecured loans present both opportunities and challenges. The opportunity lies in expanding their customer base, improving service quality, and introducing innovative lending models. However, they need to carefully manage the potential risks associated with unsecured lending, regulatory uncertainty, and market volatility. Maintaining a balanced approach that utilizes the benefits of fintech innovation while staying risk-conscious is crucial for long-term sustainability.

Headlines You Don’t Want to Miss

FTC Takes Action Against Deceptive MCA Practice The FTC has taken action against RCG Advances and associated individuals involved in the MCA sector for alleged deceptive practices. The defendants are accused of misrepresenting the nature of their product and how repayments were calculated, leading to astronomical effective annual rates (EAR). The FTC also alleges that the defendants accused businesses of breach of contract for failing to make daily repayments, leading to threats of court action and visits by the defendants' 'intimidation squad.'

Cashflows 'Advance' product, meeting the escalating demand for flexible, fixed-fee business funding solutions A business funding product offering a luxury of charging a fixed administrative fee, not linked to the drawn amount. This product addresses the soaring need for flexible business financing, aiding businesses across various sectors, especially those negatively affected by the pandemic such as hospitality, retail, and leisure.

Embedded banking market globally, predicting a compound annual growth rate (CAGR) of 23.6% to reach a total value of $1,110,667.66 million by 2032 Several factors contribute to this projected growth, including an increase in the digital customer base, focus on customized customer experiences, a trend towards open banking, and better regulations.

Comparison between 'Buy Now, Pay Later' (BNPL) plans and traditional credit cards BNPL services may cause users to overspend because the plans make large purchases seem more affordable. It suggests that despite their growing popularity, BNPL services can have hidden risks, such as harsh late payment penalties and negatively impacting credit scores and causing financial stress.

Get Free Access to our Alternative Funding Expert GPT

Get Free Access to our AI Credit Risk Tool

Create an account to Get Free Access to our Secretary of State AI Tool

Subscribe on our YouTube Channel here

See us on LinkedIn