The Consumer Financial Protection Bureau (CFPB) accused TMCC of exercising "unfair practices" by charging borrowers who paid off their auto loans early, or had their cars repossessed, without informing them about the total taken from their bank accounts electronically (Electronic Fund Transfer).

The CFPB also cited TMCC for reporting inaccurate customer information to credit reporting agencies, which could negatively affect consumers' credit scores.

TMCC agreed to the settlement without admitting to any wrongdoing.

Apart from the payment, TMCC also agreed to stop these practices and rectify the affected customers' credit reports.

Our Opinion:

One of the main arguments supporting stricter regulations is the need for protection against erroneous reporting, as seen in Toyota's case where the financial services arm was fined $60 million for failing to report accurate loan information to credit bureaus. Erroneous reporting can cause consumers to pay higher interest rates, potentially leading them to financial distress. Therefore, more stringent regulations can prevent such errors and protect consumers.

Stricter regulations would require alternative lenders to maintain a higher level of accountability, ensuring transparency in their business activities. This would protect consumers from potential abuses by firms that might seek to exploit loopholes in existing regulations. Regulations serve as the necessary check and balance in a free-market economy, fostering ethical business practices.

60% of Americans Are Living Paycheck to Paycheck

The rising cost of living in America has led to an increasing number of citizens living paycheck to paycheck, despite having a median income of more than $50,000. Living paycheck to paycheck creates a precarious financial situation where unexpected expenses become a major concern.

This economic instability generates higher stress levels among this population.

The statistics provides several important data:

60% of consumers living paycheck to paycheck in October 2023.

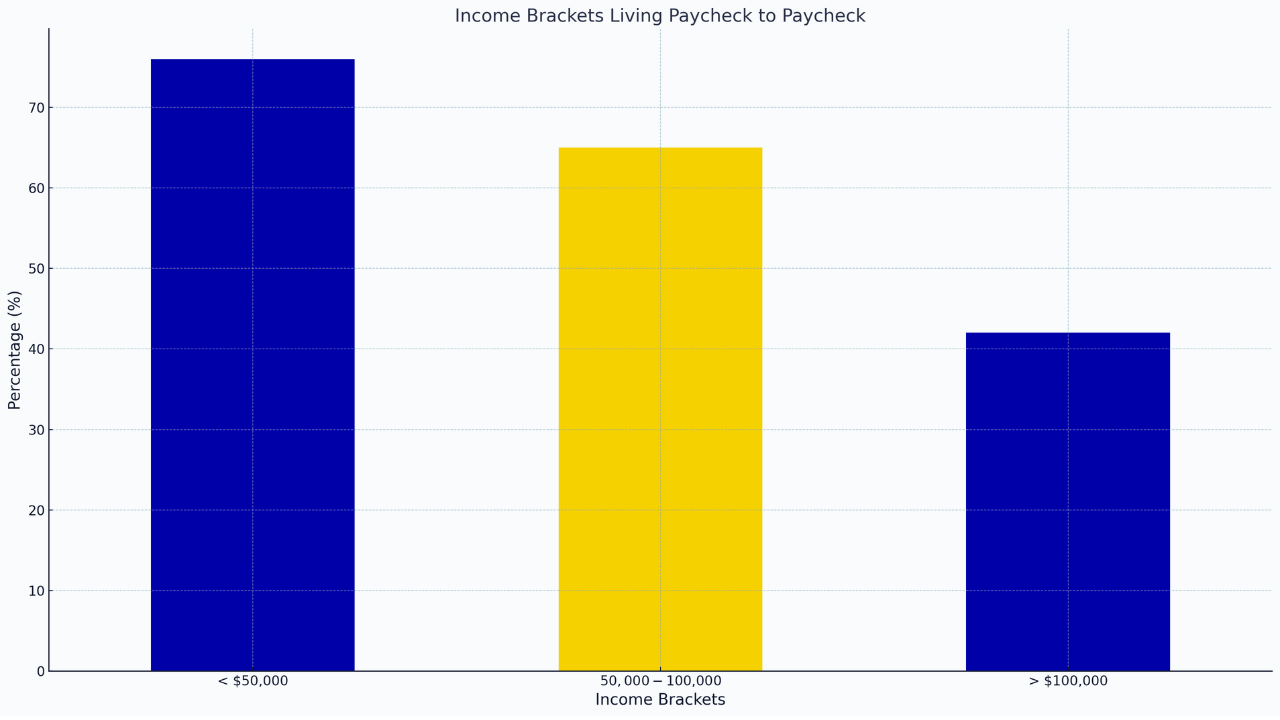

Income brackets living paycheck to paycheck:

76% earning less than $50,000.

65% earning between $50,000 and $100,000.

42% earning more than $100,000.

38% of consumers consider themselves in poorer financial health compared to 2022.

62% are very or extremely concerned about the economic outlook.

58% are seeing inflation exceed growth in their paychecks.

77% expect to shop during the 2023 holiday season.

60% cite access to fewer resources as a reason to spend less overall.

37% plan to use savings for holiday spending.

32% intend to use credit options for purchases.

Distribution of credit usage: 27% credit cards, 20% BNPL.

Our Opinion:

Understanding the financial predicaments of a large portion of the population allows lenders to tailor their services better to the needs of individuals who are living paycheck to paycheck. However, in doing so, they must ensure that the solutions offered are sustainable and do not burden their consumers with additional financial strain. It is a finely balanced issue that depends largely on the approach adopted by the alternative financing industry.

Headlines You Should Not Miss

Blackstone at the Forefront to Acquire Signature Bank's $1B Real Estate Loan Portfolio Blackstone Group, American multinational private equity and alternative investment firm, is nearing a deal to buy nearly $1 billion in commercial real estate loans from Signature Bank. Signature Bank of New York is making the move as part of its efforts to better manage its concentration risk. Blackstone is a leading bidder among several others, with the deal potentially closing before the end of June. The portfolio for sale involves mortgages on multi-family and mixed-use properties primarily located in New York

Insufficient Funding Winds up Fintech NESS Despite Promising Market Interest NESS, a fintech startup offering credit cards with dynamically changing rates based on consumer spending habits, was forced to shut down because of a lack of financial resources. The company was unable to secure a subsequent round of funding, causing them to close operations. Prior to shutdown, NESS had 4000 users on their waiting list, reflecting potential market interest in its product.

Empowering Women Financially: A Glimpse into Cinnamon Wealth’s Robo-Advisory Platform Cinnamon Wealth aims to help women bridge the existing gender wealth gap through personalized investment strategies. The algorithm-driven robo-advisory platform provides market insights and curated portfolios taking into consideration the unique financial needs and goals of women including retirement planning, care fees, and tax-efficient savings.

Get Free Access to our AI Credit Risk Tool

Create an account to Get Free Access to our Secretary of State AI Tool

Subscribe on our YouTube Channel here

See us on LinkedIn